AuguStar Life Insurance Company Announces Cash Tender Offer for Up to $250 Million Aggregate Principal Amount of Constellation Insurance, Inc.’s Outstanding 5.550% Senior Notes due 2030 (Currently Bearing Interest at a Rate of 6.800%) and 6.625% Senior Notes due 2031

AuguStar® Life Insurance Company (ALIC), a wholly owned subsidiary of Constellation Insurance, Inc. (CII), announced today the commencement of offers to purchase for cash (Offers) up to $250 million aggregate principal amount (subject to increase by ALIC in its sole discretion, the (Aggregate Tender Cap) ) of CII’s outstanding notes listed in the table below, provided that ALIC will not accept for purchase more than (i) $175.0 million aggregate principal amount (subject to increase by ALIC in its sole discretion (2030 Series Cap) ) of the 5.550% senior notes due 2030 (2030 Notes) and (ii) $75.0 million aggregate principal amount (subject to increase by ALIC in its sole discretion (2031 Series Cap) and, together with the 2030 Series Cap, each a (Series Cap) ) of the 6.625% senior notes due 2031 (2031 Notes) and, collectively with the 2030 Notes, the (Notes). The Offers are being made pursuant to the Offer to Purchase dated August 12, 2025 (Offer to Purchase).

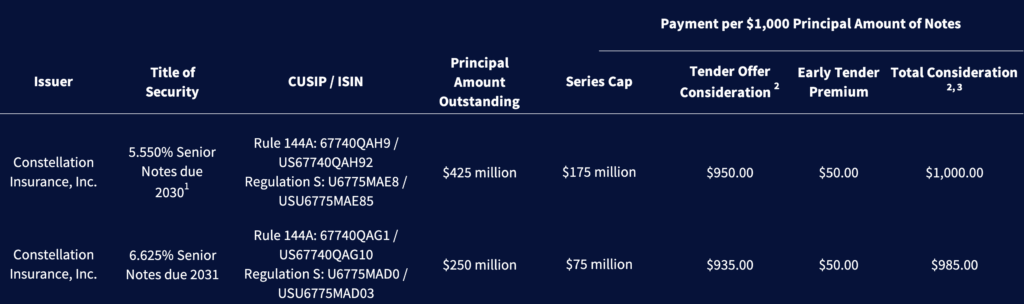

Certain information regarding the Notes and the terms of the Offers are summarized in the table below.

1 As of the date of this Offer to Purchase, the 2030 Notes bear interest at a rate of 6.800%, reflecting an increase that became effective in July 2022 as a result of Moody’s ratings downgrade of the 2030 Notes to Ba1, following S&P’s withdrawal of its rating of the 2030 Notes.

2 Not including Accrued Interest (as defined herein), which will be paid in addition to the Tender Offer Consideration or Total Consideration, as applicable.

3 Includes the Early Tender Premium.

The Offers are scheduled to expire at 5 p.m. ET on September 10, 2025 (such time and date, as it may be extended, the Expiration Time). Holders of Notes who validly tender (and do not validly withdraw) their Notes at or prior to 5 p.m. ET on August 25, 2025 (such time and date, as it may be extended, the Early Tender Deadline) will be eligible to receive the applicable Total Consideration for such Notes, which includes the Early Tender Premium. Holders of Notes who validly tender their Notes after the Early Tender Deadline but at or prior to the Expiration Time will not be eligible to receive the Early Tender Premium and will therefore only be eligible to receive the applicable Tender Offer Consideration. In addition, ALIC will pay accrued and unpaid interest on the principal amount of Notes accepted for purchase from the most recent interest payment date on the Notes to, but not including, the applicable settlement date for the Notes accepted for purchase (Accrued Interest). Validly tendered Notes may be validly withdrawn at any time prior to the Early Tender Deadline but not thereafter, except as may be required by applicable law.

If the aggregate principal amount of a series of Notes validly tendered (and not validly withdrawn) at or prior to the Early Tender Deadline or the Expiration Time, as the case may be, exceeds the Aggregate Tender Cap or the applicable Series Cap, a prorated amount of Notes of such series validly tendered (and not validly withdrawn) by holders at or prior to the Early Tender Deadline or the Expiration Time, as the case may be, will be accepted for purchase.

If the aggregate principal amount of the Notes of either series validly tendered in the Offers at or prior to the Early Tender Deadline exceeds the Aggregate Tender Cap or any Series Cap, Notes of such series tendered after the Early Tender Deadline will not be eligible for purchase, unless the Aggregate Tender Cap or the applicable Series Cap is increased by us in our sole discretion.

ALIC’s obligation to purchase Notes in any of the Offers is conditioned on the satisfaction or waiver of a number of conditions as described in the Offer to Purchase. Neither of the Offers is conditioned upon the tender of any minimum principal amount of Notes of such series or of the other series. However, the Offers are subject to the Aggregate Tender Cap and each applicable Series Cap. ALIC reserves the right, but is under no obligation, to increase the Aggregate Tender Cap and/or one or both Series Caps at any time, subject to compliance with applicable law. In the event of a termination of an Offer, neither the applicable consideration will be paid or become payable to the holders of the applicable series of Notes, and the Notes tendered pursuant to such Offer will be promptly returned to the tendering holders. ALIC has the right, in its sole discretion, to not accept any tenders of Notes for any reason and to amend or terminate an Offer at any time.

Copies of the Offer to Purchase are available to holders of the Notes from D.F. King & Co., Inc., the tender agent and information agent for the Offers (the “Tender and Information Agent”). Requests for copies of the Offer to Purchase should be directed to the Tender and Information Agent at +1 (866) 620-2536 (toll free) and +1 (212) 269-5550 (collect) or by e-mail to [email protected]. ALIC Life has engaged BMO Capital Markets Corp. and Truist Securities, Inc. as dealer managers for the Offers. Questions regarding the terms of the Offers may be directed to BMO Capital Markets Corp. at +1 (212) 702-1840 (collect) or +1 (833) 418-0762 (toll-free); and Truist Securities, Inc. at +1 (404) 926-5262 (collect) or +1 (833) 594-7730 (toll-free).

None of ALIC, CII, the dealer managers, the Tender and Information Agent, the trustee for the Notes or any of their respective affiliates is making any recommendation as to whether holders should or should not tender any Notes in response to the Offers or expressing any opinion as to whether the terms of the Offers are fair to any holder. Holders of the Notes must make their own decision as to whether to tender any of their Notes and, if so, the principal amount of Notes to tender. Please refer to the Offer to Purchase for a description of the offer terms, conditions, disclaimers and other information applicable to the Offers.

This press release does not constitute an offer to purchase or the solicitation of an offer to sell any securities. The Offers are being made solely by means of the Offer to Purchase. ALIC is making the Offers only in those jurisdictions where it is legal to do so. The Offers are not being made to holders of the Notes in any jurisdiction in which the making or acceptance thereof would not be in compliance with the securities, blue sky or other laws of such jurisdiction.

Forward-Looking Statements

This news release contains “forward-looking statements,” which involve risks and uncertainties often, but not always, identified through the use of words or phrases such as “believes,” “plans,” “intends,” “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimated,” “projection,” “target,” “goal,” “objective,” “outlook” and similar expressions. Where, in any forward-looking statement, we express an expectation or belief as to future results or events, such expectation or belief is expressed in good faith and believed to have a reasonable basis, but there can be no assurance that the expectation or belief will result or be accomplished.

About AuguStar Life Insurance Company

AuguStar Life Insurance Company (ALIC) is a direct, wholly-owned subsidiary of Constellation Insurance Inc (CII). AuguStar manufactures and distributes a range of life insurance and annuity products designed for individuals and small businesses, including whole life insurance, universal life insurance, variable universal life insurance, term life insurance and individual fixed and fixed indexed annuities.

About Constellation Insurance, Inc.

Constellation Insurance, Inc. is a diversified financial services group offering insurance, reinsurance, asset management and institutional markets solutions through AuguStar Retirement, AuguStar Life, AuguStar Seguros, Constellation Investments, Constellation Re and Constellation Institutional Markets. Constellation’s investors and equal partners, CDPQ and Ontario Teachers’, are two of the largest long-term institutional investors in North America.